SOFTWARE

AND TOOLS

About

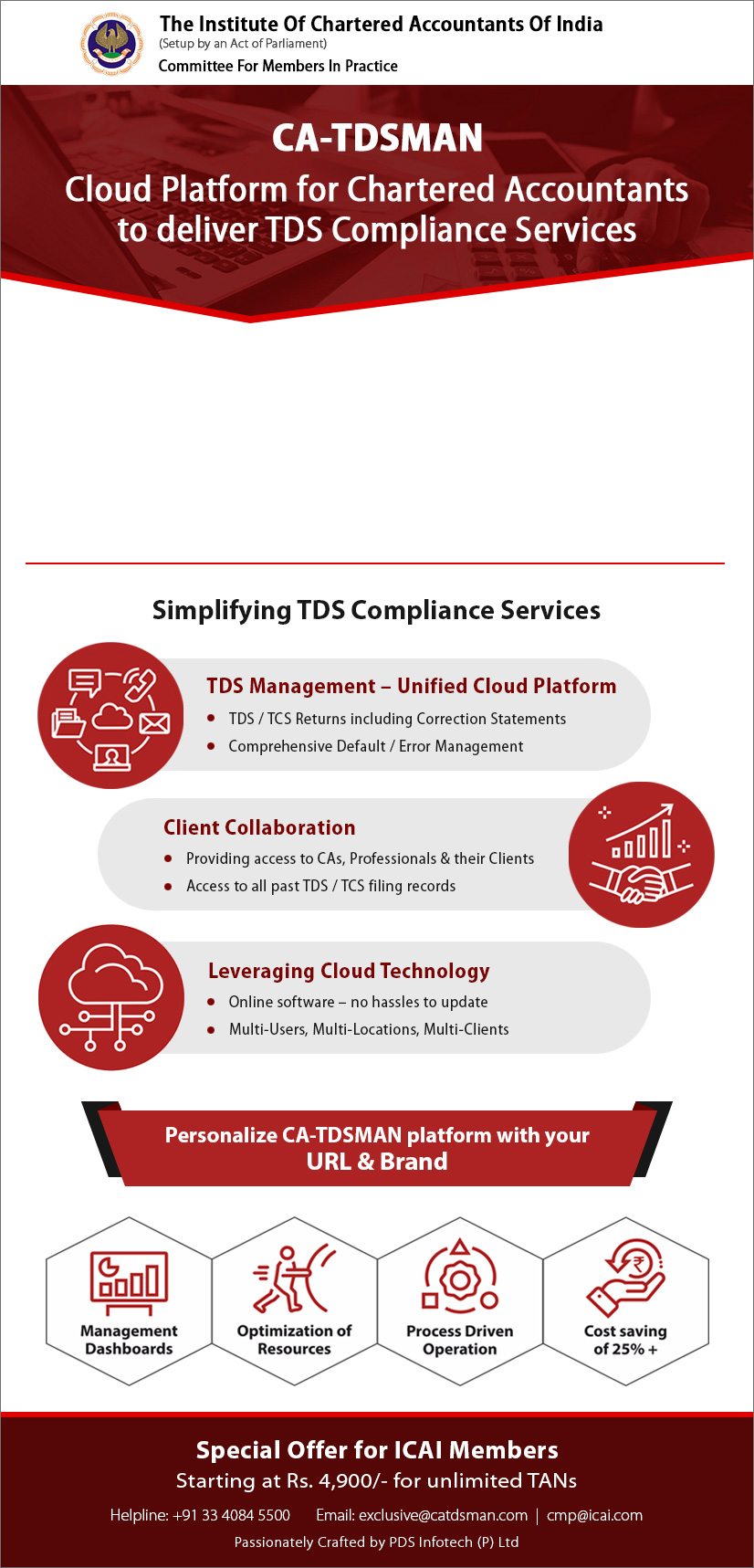

CA-TDSMAN is a cloud-based TDS compliance platform by PDS Infotech Pvt Ltd, designed for Chartered Accountants to manage TDS/TCS returns, deliver services to clients, and ensure seamless compliance. It offers a unified solution for filing, error correction, and client collaboration, with multi-user/multi-location access and no updates hassles.

Key Features

- TDS Management: Unified cloud platform for TDS/TCS returns, including default/error correction statements.

- Client Collaboration: Access for CAs, professionals, and clients to all past filing records.

- Cloud Technology: Online software for multi-users, multi-locations, multi-clients; leverages AI for efficiency.

- Personalization: Custom URL and branding; management dashboards, process-driven operations.

- Additional: Comprehensive default/error management, resource optimization, cost savings.

Benefits

- Simplifies TDS compliance services with hassle-free updates and scalable access.

- Enhances collaboration between CAs and clients for better record access.

- Drives 25%+ cost savings through optimized resources and process automation.

- Provides real-time dashboards for management and error-free filings.

Discounted Pricing for ICAI Members

|

Plan |

Regular Price |

ICAI Discounted Price |

TANs/Records |

Validity |

|

Annual Subscription |

₹5,900 |

₹4,900 |

Unlimited / 10,000 |

1 Year |

How to Avail CA-TDSMAN Service

Members may please visit: https://www.ca.tdsman.com/ca-special/authentication.aspx and register through Membership No. to avail the discount prices.

Contact Information

- Support Team Phone- Mb No. +91 33 4084 5500| Email: exclusive@catdsman.com

- For further assistance, Please contact Mr. Pawan Chaudhary: Mb. 9999236935| Email: pawan.kumar@pdsinfotech.com

Please click here to Avail this offer ( CA-TDSMAN )

Disclaimer:

ICAI, through CMP, acts solely as a facilitator for these initiatives. All services are delivered directly by respective providers. It does not endorse or guarantee the quality, reliability, or accuracy of these offerings. Members are advised to exercise independent judgment and due diligence before availing any product or service. ICAI shall not be liable for any loss or damage arising from their use.