SOFTWARE

AND TOOLS

About

SPEQTA GST Software is a tool for ICAI members and CA firms that simplifies GST annual return preparation and reconciliation. It automates the comparison between GSTR-3B, GSTR-1, and books of accounts, producing audit-ready reports for compliance and detailed analysis. With its streamlined workflow, users can reduce manual effort, minimize errors, and ensure timely submission of returns.

Key Features

- Compare filed GSTR-3B vs GSTR-1 for FY in single click.

- Compare tax paid per GSTR-3B vs tax payable in GSTR-1 & tax per books.

- Month-wise ITC availed in GSTR-3B vs ITC available in GSTR-2A.

- Cash Ledger/Credit Ledger/Liability Ledger in single click.

- Challan Deposit Summary Report for FY.

- Interest and Late Fees Paid Report.

- GSTR-1 wise Report; GSTR-1 Customer wise Report.

- GSTR-2A Supplier wise Report; Interest & Late Fees Paid Report.

- ITC Claimed vs ITC Utilized Report.

- Supplier wise GSTR-2A Report; Customer wise GSTR-1 Report.

Benefits

- Simplifies GST reconciliation and audit preparation.

- Ensures accurate ITC claims and tax liability matching.

- Saves time with single-click comparisons and automated reports.

- Enhances compliance for CA firms handling multiple clients.

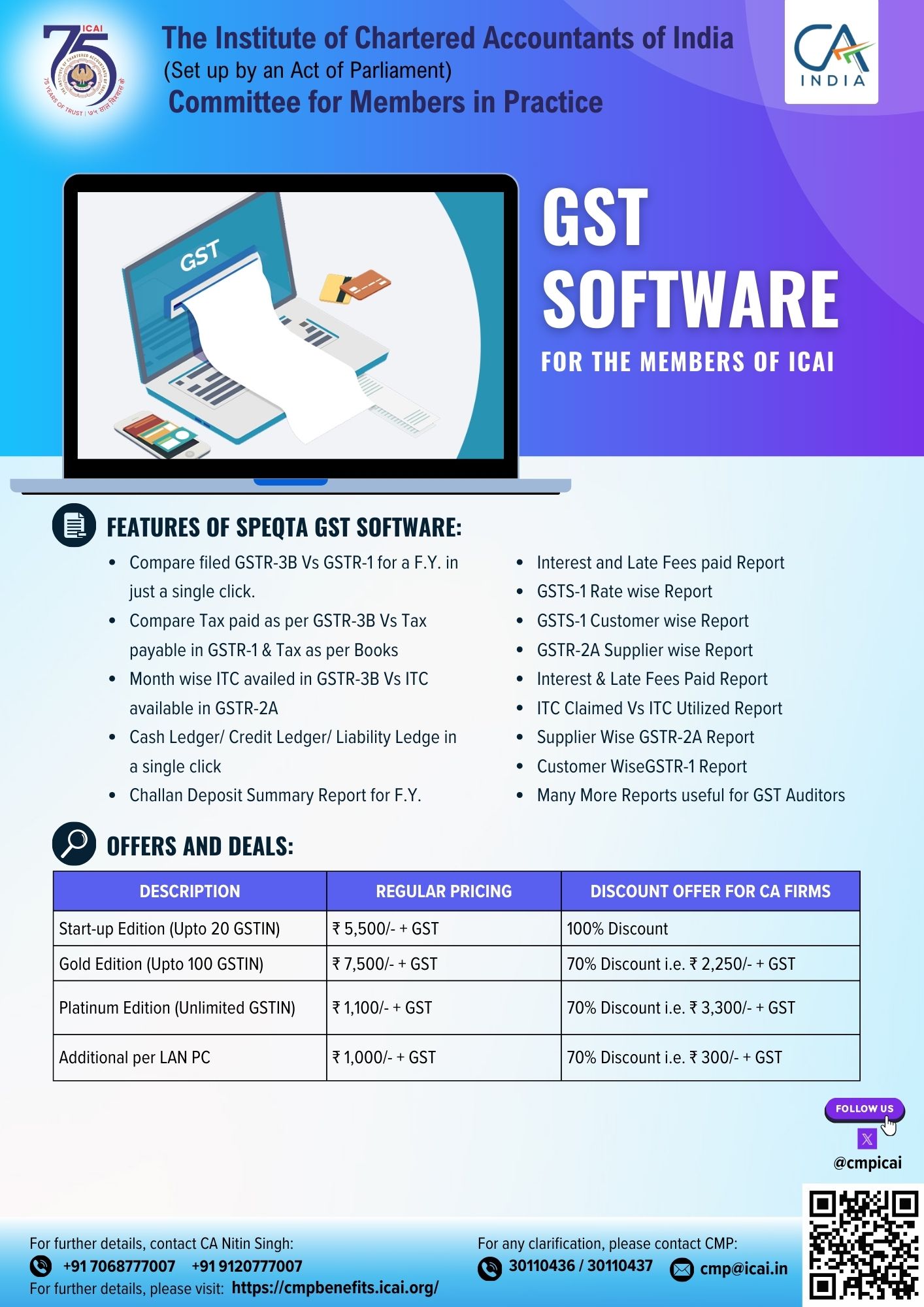

Discounted Pricing for ICAI Members & CA Firms

|

Description |

Regular Price (+ GST) |

Discounted Price (+ GST) |

Discount |

|

Start-up Edition (Up to 20 GSTIN) |

₹5,500 |

₹2,500 |

100% off regular? Wait, 55% off (calculated as 100% discount error in flyer, but math shows 55%) |

|

Gold Edition (Up to 100 GSTIN) |

₹7,500 |

₹2,250 |

70% |

|

Platinum Edition (Unlimited GSTIN) |

₹11,000 |

₹3,300 |

70% |

|

Additional per LAN PC |

₹1,000 |

₹300 |

70% |

How to Avail the Speqta GST Software Services

- Members are requested to visit https://gst.speqtalive.com/.

- Please register using your ICAI Membership Number for validation to avail the discounted prices.

Contact Information

- Mr. Nitin Phone: +91 7068777007 / +91 9120777007

- Email: support@speqtalive.com

Please click here to avail this offer ( https://gst.speqtalive.com/ )

Disclaimer:

ICAI, through CMP, acts solely as a facilitator for these initiatives. All services are delivered directly by respective providers. It does not endorse or guarantee the quality, reliability, or accuracy of these offerings. Members are advised to exercise independent judgment and due diligence before availing any product or service. ICAI shall not be liable for any loss or damage arising from their use.