INSURANCE

SERVICES

About

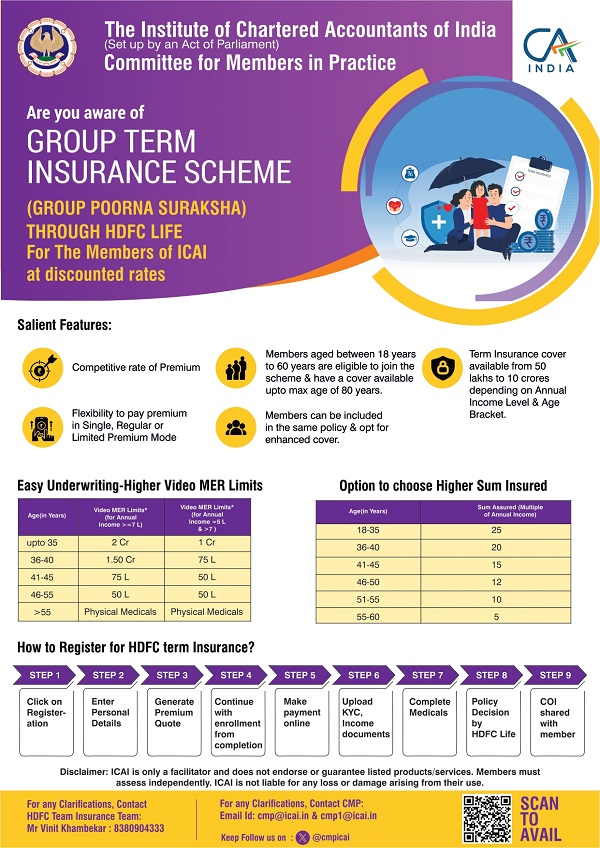

HDFC Group Poorna Suraksha (GPS) is a non-linked, non-participating group term insurance plan offered exclusively to the members of ICAI under the CMP Insurance initiative. The plan provides life cover with the option of accelerated critical illness benefit, flexible premium payment options, and continuation of coverage even if a member leaves the group.

Benefits

- Comprehensive Protection – Provides life cover with optional accelerated critical illness benefit.

- Flexible Premium Payment – Choice of Single Pay, Regular Pay, or Limited Pay (5 / 10 / 12 / 15 years).

- Customised Sum Assured – Coverage starts from ₹30 lakh and can go up to ₹1 crore or more.

- Settlement Flexibility – Nominee can opt for lump sum or instalment payouts (5 to 15 years).

- Entry Age Flexibility – Members aged between 18years to 60years are eligible to join the Scheme & have a cover available up to max. age of 80years.

Discounted Pricing for ICAI Members

- Exclusive Group Rates: Specially negotiated premium rates are available for the members under the CMP tie-up arrangement.

- Personalized Calculation: Premium is determined by the member’s age, selected sum assured, and chosen payment option.

How to Avail HDFC Group Poorna Suraksha (GPS)

- Members may visit the CMP Portal (HDFC Group Term Insurance) and click on “Avail.”

- Select Organisation: ICAI Members.

- Enter ICAI membership details & generate quote.

- Choose sum assured, term & payment option.

- Fill online form, upload KYC/required documents.

- Pay premium online.

- Policy issued after verification.

Contact Information:

Vinit Khambekar (Senior manager) – 8380904333| vinit.khambekar@hdfclife.com

Disclaimer:

ICAI, through CMP, acts solely as a facilitator for these initiatives. All services are delivered directly by respective providers. It does not endorse or guarantee the quality, reliability, or accuracy of these offerings. Members are advised to exercise independent judgment and due diligence before availing any product or service. ICAI shall not be liable for any loss or damage arising from their use.